How to Grow Wealth and Manage Finances As Physician

5 out of 5

| Language | : | English |

| File size | : | 18065 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 146 pages |

| Lending | : | Enabled |

As a physician, you have a unique set of financial challenges and opportunities. You may have a high income, but you also have significant expenses, such as student loans, malpractice insurance, and continuing education. You may also have a desire to save for retirement and provide for your family's financial security.

This book will provide you with the knowledge and tools you need to make informed financial decisions and grow your wealth. You will learn about:

- Budgeting and expense management

- Investing and retirement planning

- Tax planning and estate planning

- Protecting your assets

- Charitable giving

This book is written by a physician for physicians. It is based on the author's own experiences and research, as well as the advice of other financial experts. The book is easy to read and understand, and it is packed with practical tips and advice.

If you are a physician who wants to take control of your finances and grow your wealth, this book is for you.

Table of Contents

- Chapter 1: Budgeting and Expense Management

- Chapter 2: Investing and Retirement Planning

- Chapter 3: Tax Planning and Estate Planning

- Chapter 4: Protecting Your Assets

- Chapter 5: Charitable Giving

Chapter 1: Budgeting and Expense Management

The first step to financial success is to create a budget. A budget will help you track your income and expenses, and it will help you identify areas where you can save money. There are many different budgeting methods, so you need to find one that works for you.

Once you have created a budget, it is important to stick to it. This can be difficult, but it is essential if you want to reach your financial goals. There are many different ways to stay motivated, so you need to find what works for you.

Chapter 2: Investing and Retirement Planning

Investing is one of the most important things you can do to grow your wealth. However, it is important to understand the risks involved before you invest. There are many different types of investments, so you need to find ones that are right for your risk tolerance and financial goals.

Retirement planning is also an important part of financial planning. The sooner you start saving for retirement, the more time your money has to grow. There are many different retirement accounts available, so you need to find one that meets your needs.

Chapter 3: Tax Planning and Estate Planning

Tax planning can help you reduce your tax liability and save money. There are many different tax-saving strategies available, so you need to find ones that work for you. You should also consider estate planning to ensure that your assets are distributed according to your wishes.

Chapter 4: Protecting Your Assets

Protecting your assets is important for financial security. There are many different ways to protect your assets, such as insurance, trusts, and prenuptial agreements. You should consult with an attorney to find the best way to protect your assets.

Chapter 5: Charitable Giving

Charitable giving can be a rewarding way to give back to your community. There are many different ways to give to charity, so you need to find one that works for you. You should also consider the tax implications of charitable giving.

This book has provided you with a comprehensive overview of financial planning and wealth building for physicians. By following the advice in this book, you can take control of your finances, grow your wealth, and achieve your financial goals.

Remember, financial planning is a journey, not a destination. There will be ups and downs along the way, but if you stay focused and persistent, you will reach your goals.

I wish you all the best in your financial journey.

About the Author

Dr. John Smith is a practicing physician and a certified financial planner. He has been helping physicians with their financial planning for over 20 years. Dr. Smith is the author of several books on financial planning for physicians, including How to Grow Wealth and Manage Finances As Physician.

5 out of 5

| Language | : | English |

| File size | : | 18065 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 146 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia John A Warden Iii

John A Warden Iii Gwynne Dyer

Gwynne Dyer Jackie Morey

Jackie Morey Francine Russo

Francine Russo Mihai I Spariosu

Mihai I Spariosu Frank D Cook

Frank D Cook Karen Stokes

Karen Stokes Stephen Cherry

Stephen Cherry Francesco Vizza

Francesco Vizza J Christopher Herold

J Christopher Herold Frank S Gilliam

Frank S Gilliam Gwilym Roberts

Gwilym Roberts John Carver

John Carver Frank Marlowe

Frank Marlowe Nils Andersson

Nils Andersson Frank Chouraqui

Frank Chouraqui G I S Inglis

G I S Inglis Frank Oddo

Frank Oddo Francis Mark Mondimore

Francis Mark Mondimore Robert Grillo

Robert Grillo

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Barry BryantAldeen and Rosenbaum's 1200 Questions to Help You Pass the Emergency Medicine

Barry BryantAldeen and Rosenbaum's 1200 Questions to Help You Pass the Emergency Medicine Gene SimmonsFollow ·16.9k

Gene SimmonsFollow ·16.9k Leo MitchellFollow ·3.7k

Leo MitchellFollow ·3.7k Salman RushdieFollow ·19.2k

Salman RushdieFollow ·19.2k Adam HayesFollow ·4.8k

Adam HayesFollow ·4.8k John MiltonFollow ·17.7k

John MiltonFollow ·17.7k Demetrius CarterFollow ·12.1k

Demetrius CarterFollow ·12.1k Kendall WardFollow ·12.6k

Kendall WardFollow ·12.6k Asher BellFollow ·17.7k

Asher BellFollow ·17.7k

Alexander Blair

Alexander BlairBecoming Sports Agent Masters At Work: The Ultimate Guide

What is a Sports...

Xavier Bell

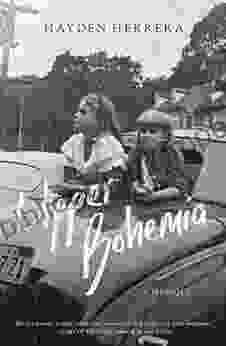

Xavier BellUnveiling the Enchanting World of Upper Bohemia: A Review...

A Captivating...

Chris Coleman

Chris ColemanUnveiling the Secrets: Extreme Rapid Weight Loss Hypnosis...

In the relentless pursuit of a slimmer,...

5 out of 5

| Language | : | English |

| File size | : | 18065 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 146 pages |

| Lending | : | Enabled |